If you’re in the property management industry you’ve probably just taken it for granted that the main process you manage is to collect rental from tenants, deposit it in a trust account, and then distribute it to the landlords.

If you’re in the property management industry you’ve probably just taken it for granted that the main process you manage is to collect rental from tenants, deposit it in a trust account, and then distribute it to the landlords.

This was an expensive process to manage and came with a high degree of risk for the licensed business owner. If you had 500 properties under management, you probably employed around 5 or 6 people who would all have some sort of access to your trust account.

And with that many people having access to a large amount of funds on deposit things have a habit of occasionally going pear shaped.

As an example, for the above 500 properties the agency would have historically held over $1 million in bonds alone, that’s money that will not missed for a year or so and could easily be misappropriated by a smart but dishonest employee.

The government came to understand this risk many years ago and as a result enacted legislation and set up state regulatory bodies to oversee the process.

But here’s the rub for the business owner. The regulator is set up to protect the consumer, not you. All the legislation and regulatory protection is for the benefit of the consumer, and at your risk.

We often hear Agents say “I’m protected by the Fidelity Fund” - if only this was true. The Fidelity Fund in each state is underwritten via interest on the trust deposits but it is only available to cover consumer claims. If a consumer makes a claim that is paid by the fund the regulator will then reclaim this amount from the licensee of the business that was managing the deficient trust account.

So the consumer gets their money returned, but it’s the licensee that eventually has to make the reimbursement. If your employee misappropriates money from your trust you essentially have to reimburse the trust account from your own pocket.

This is a pretty big risk to bear if you have millions of dollars circulating in your trust account. You can of course insure against some of this, but many aspects aren’t covered, and coverage is expensive and often tricky to claim.

Well, as Bob Dylan once said, the times they are a changing….

With revolutionary changes in banking process, and the intersection of the proptech and fintech worlds, we now have options that simply didn’t exist a few years ago.

In 2022 a property management business can operate without managing an in office trust account. You can retain complete control over the funds, both collection and disbursement – but you never have to take physical possession of those funds, so you don’t need a trust account and you avoid all the risk that comes with taking possession of the funds.

If you use our.property as your platform you also have a significant benefit that none of the other available options can offer you – the continued protection of your clients funds by the Fidelity Fund in each state.

Our.Property is the only payments platform that is licensed in each state of Australia to collect and disperse rental, and all funds are settled via a regulated trust account meaning the funds in that account are protected by each states Fidelity Fund - and instead of you, OurProperty Payments holds the risk of that consumer protection.

The major risk of employee misappropriation is removed as staff can no longer manipulate the process. Items such as landlord bank account changes require double authentication and there are automated warnings that go to all parties whenever something like an account change is made. Transparency and automated processes give you and your clients protection

What other risks can you say goodbye to with an automated payments process?

One if the main risks in property management (and property investment) is getting the rent paid in full and on time.

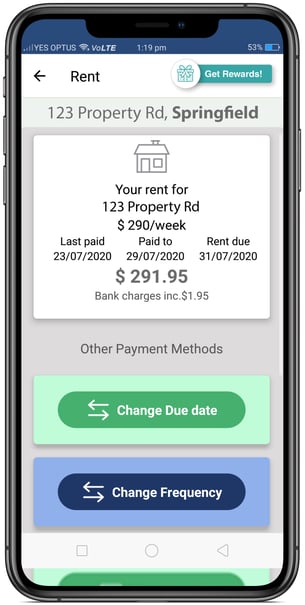

Traditionally rent is paid by a ‘push’ payment – this means that the tenant ‘pushes’ the payment to the Agent. In the lease it might state that the rent is $3,000 a month and due on the 1st of the month, but every month your tenant decides when they are actually going to pay and how much they will pay, they might be away on a holiday so don’t get onto the payment till the 5th, or they could be a bit short and decide they’ll only pay half ($1,500) now and the balance next week. As the agent you have no control over this, and for the owner you never really know what you will get, or when – this can cause a lot of friction if the landlord relies on these funds to pay the mortgage.

Traditionally rent is paid by a ‘push’ payment – this means that the tenant ‘pushes’ the payment to the Agent. In the lease it might state that the rent is $3,000 a month and due on the 1st of the month, but every month your tenant decides when they are actually going to pay and how much they will pay, they might be away on a holiday so don’t get onto the payment till the 5th, or they could be a bit short and decide they’ll only pay half ($1,500) now and the balance next week. As the agent you have no control over this, and for the owner you never really know what you will get, or when – this can cause a lot of friction if the landlord relies on these funds to pay the mortgage.

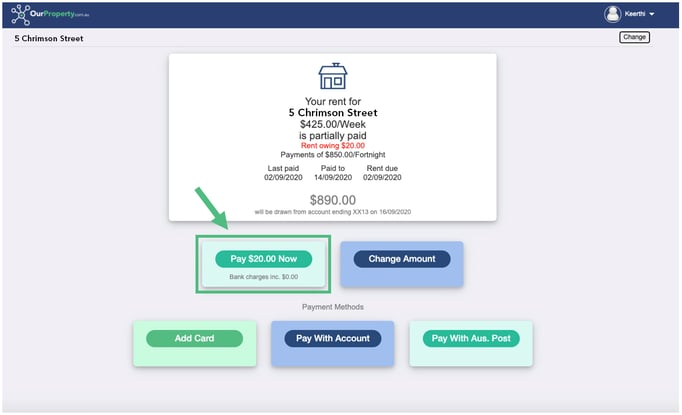

When you switch to our.property you change this whole dynamic, the rent is now ‘pulled’ by you rather than being ‘pushed’ by the tenant.

The primary methods are to be pulled from an account via a Direct Debit or the soon to be active ‘Pay to’ channel of the NPP (New Payment Platform), or to be pulled via a card payment (much as you now do with Uber etc).

You now control when the payment is made and how much it is – all done in accordance with the property lease that the landlord and tenant have already agreed to.

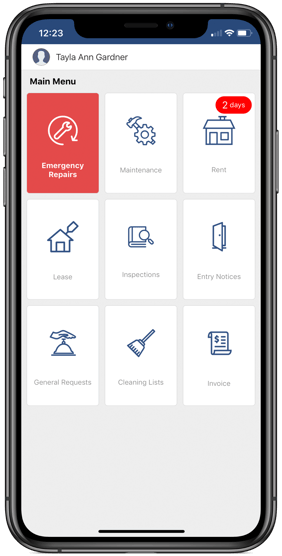

And the best part is that your tenants are already completely used to this style of process (every app like Uber uses it) and the tenant experience is enhanced, they now have a complete ‘set and forget’ option and they also have unlimited flexibility with the option of registering multiple accounts and cards and changing the method used whenever they would like to.

By then integrating the payments process back to an automated arrears process you can immediately manage the arears in a way that is guaranteed to get the best results.

Targeted communications to the tenant using proven artificial intelligence to understand the most appropriate communication channels, the best frequency, and the right messaging for a particular tenant, and then a simple in app click through to instigate the payment.

A great automated system also has multiple payment re tries and well as sophisticated processes like open banking where the system can look into the tenants account prior to the payment processing to understand if the funds are there or not. The advantage of this is that you can start an arrears process immediately rather than waiting 3 days for a declined payment, you also save the tenant $20 or more in overdraw fees which gives you a greater chance of clearing your payment on the next day.

So in a nutshell an automated 3rd party payments system gives a property management agency some huge advantages, but you need to look at what system you’re adopting and understand if you’re getting all the protections you need – the main thing to look for is does the platform settles funds through a regulated trust account (or are they just using a normal bank account that is owned and operated by a processor that they utilise – ie a 4th string party).

Increase your rewards and reduce your risks.

Ay our.property we have a team of client relationship managers than can talk you though the processes and you can also see a number of client testimonials both written and in video on our web site. We’re very proud to say that a number of Australia’s leading property management companies are already on platform with portfolio sizes of up to 7,000+ properties.